Archives

Occupancy growth is being confirmed

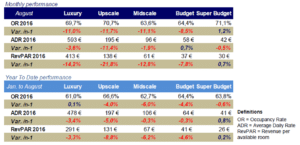

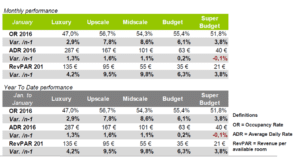

HOTEL INDUSTRY PERFORMANCES – FABRUARY 2017

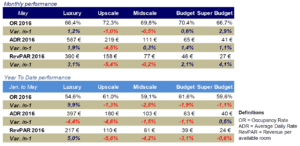

Occupancy grew in February 2017 in all categories except the Luxury segment throughout most of France. The Luxury and Budget sectors were the only ones to record a drop in RevPAR in February alone, although all categories posted higher RevPAR over the first two months of the year – nearly +7% higher for Midscale hotels and over +6% for Upscale hotels.

On a national scale, categories at the lower end of the spectrum posted a drop in ADR in February, although Midscale and Super-budget hotels compensated for this by recording higher occupancy. For Luxury hotels, the opposite was true – although occupancy dropped (-3,7%), the rise in average rates limited the decline in RevPAR.

On a national scale, categories at the lower end of the spectrum posted a drop in ADR in February, although Midscale and Super-budget hotels compensated for this by recording higher occupancy. For Luxury hotels, the opposite was true – although occupancy dropped (-3,7%), the rise in average rates limited the decline in RevPAR.

The green shoots of recovery are there

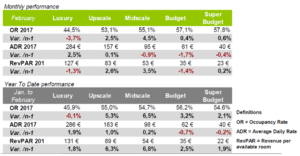

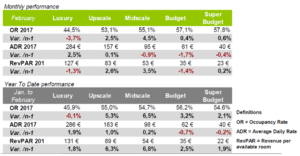

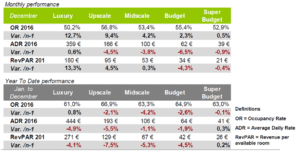

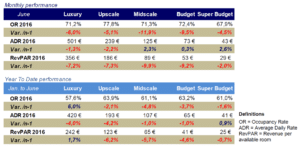

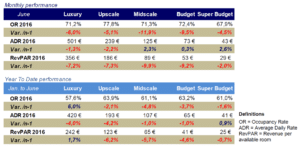

HOTEL INDUSTRY PERFORMANCES – JANUARY 2017

Since the end of 2016, tourist demand has begun to recover in France, with January confirming the trend. Tourist demand was supported by Regional France and Ile-de-France, with encouraging results observed on the Midscale and Upscale markets. Hotels on the Côte d’Azur were the only ones to experience a decline in RevPAR in January.

In January 2017, the French hotel industry generally recorded positive RevPAR growth in all categories – from +4% on the Super-budget market to +10°% on the Midscale market. These results were primarily down to Regional France and the Paris region, with the Côte d’Azur being the only destination to post a decline in RevPAR. On a country-wide scale, the Midscale and Upscale markets recorded the most encouraging performances.

The year ends on a positive note

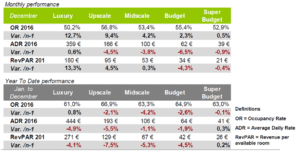

HOTEL INDUSTRY PERFORMANCES – DECEMBER 2016

The French hotel industry – and the Paris region in particular – ended December with a  glimmer of hope. Occupancy rates grew in all categories. The Luxury segment stood out in December, with +13% growth in RevPAR, thanks to high demand in Regional France (excluding the Côte d’Azur) and Paris: occupancy grew by +12% and +24%, respectively. Year-end results showed that the Super-budget segment played its cards right – the only segment to finish the year with a higher RevPAR (+0,2%).

glimmer of hope. Occupancy rates grew in all categories. The Luxury segment stood out in December, with +13% growth in RevPAR, thanks to high demand in Regional France (excluding the Côte d’Azur) and Paris: occupancy grew by +12% and +24%, respectively. Year-end results showed that the Super-budget segment played its cards right – the only segment to finish the year with a higher RevPAR (+0,2%).

glimmer of hope. Occupancy rates grew in all categories. The Luxury segment stood out in December, with +13% growth in RevPAR, thanks to high demand in Regional France (excluding the Côte d’Azur) and Paris: occupancy grew by +12% and +24%, respectively. Year-end results showed that the Super-budget segment played its cards right – the only segment to finish the year with a higher RevPAR (+0,2%).

glimmer of hope. Occupancy rates grew in all categories. The Luxury segment stood out in December, with +13% growth in RevPAR, thanks to high demand in Regional France (excluding the Côte d’Azur) and Paris: occupancy grew by +12% and +24%, respectively. Year-end results showed that the Super-budget segment played its cards right – the only segment to finish the year with a higher RevPAR (+0,2%).November heralds a return to optimism

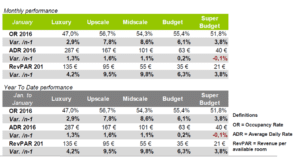

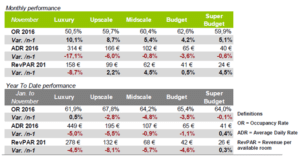

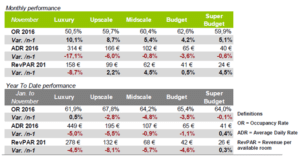

HOTEL INDUSTRY PERFORMANCES – NOVEMBER 2016

In all categories, occupancy grew in November: up to +10% in the Luxury segment on a  country-wide level, even if this segment continued to lag in Paris. Although average rates remained down in all categories, the Luxury segment was the only one to record a fall in RevPAR (-8,7%). All other categories recorded higher performances. Given the results thus far this year, November almost looks to herald good news!

country-wide level, even if this segment continued to lag in Paris. Although average rates remained down in all categories, the Luxury segment was the only one to record a fall in RevPAR (-8,7%). All other categories recorded higher performances. Given the results thus far this year, November almost looks to herald good news!

country-wide level, even if this segment continued to lag in Paris. Although average rates remained down in all categories, the Luxury segment was the only one to record a fall in RevPAR (-8,7%). All other categories recorded higher performances. Given the results thus far this year, November almost looks to herald good news!

country-wide level, even if this segment continued to lag in Paris. Although average rates remained down in all categories, the Luxury segment was the only one to record a fall in RevPAR (-8,7%). All other categories recorded higher performances. Given the results thus far this year, November almost looks to herald good news! No Indian summer for French hotels

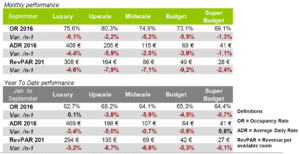

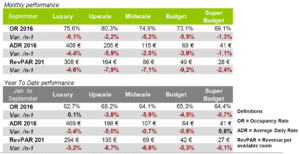

HOTEL INDUSTRY PERFORMANCES – SEPTEMBER 2016

September saw a decline in occupancy and average rates for all categories, with all major areas in France affected. Ile-de-France, the Côte d’Azur, and even Regional France,  recorded lower RevPAR in all segments, with the exception of Luxury. However, given the solid performances recorded since early 2016, year-to-date results for Regional France are still up on last year’s performances. Yet given the underlying trend, certain hoteliers have been forced to scale down their Q4 forecasts.

recorded lower RevPAR in all segments, with the exception of Luxury. However, given the solid performances recorded since early 2016, year-to-date results for Regional France are still up on last year’s performances. Yet given the underlying trend, certain hoteliers have been forced to scale down their Q4 forecasts.

recorded lower RevPAR in all segments, with the exception of Luxury. However, given the solid performances recorded since early 2016, year-to-date results for Regional France are still up on last year’s performances. Yet given the underlying trend, certain hoteliers have been forced to scale down their Q4 forecasts.

recorded lower RevPAR in all segments, with the exception of Luxury. However, given the solid performances recorded since early 2016, year-to-date results for Regional France are still up on last year’s performances. Yet given the underlying trend, certain hoteliers have been forced to scale down their Q4 forecasts. A more challenging than expected summer season

HOTEL INDUSTRY PERFORMANCES – AUGUST 2016

Hotel performances for August in Paris and, as feared, on the Côte d’Azur dragged down the results for the industry as a whole, in spite of the encouraging performances recorded in Regional France and in Coastal areas. Altogether, RevPAR fell in all categories, except in the Super-budget segment. The Upscale and Luxury categories were the most affected over the two summer months.

August proved complicated, even catastrophic for a good proportion of hoteliers in Ile-de-France. The anticipative aggressive pricing strategies implemented by certain operators had no impact. The combined fall in demand and average rates dragged down RevPAR at a rate seldom seen before.

Regional France withstood

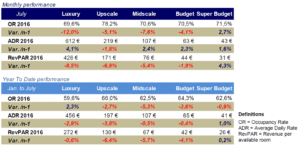

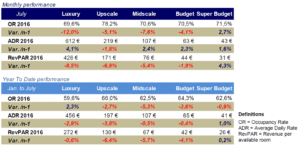

HOTEL INDUSTRY PERFORMANCES – JULY 2016

The Euro championships organised in France and the daily hotel performa nces communicated by our partner, STR, signalled some hope for July. Paris and the Côte d’Azur finished July on a very negative note, with RevPAR significantly dropping in all categories, given the sharp decline in occupancy. However, Regional France withstood better, recording encouraging increases in RevPAR (+4% to +9%, depending on the category), boosted by growth in average rates.

nces communicated by our partner, STR, signalled some hope for July. Paris and the Côte d’Azur finished July on a very negative note, with RevPAR significantly dropping in all categories, given the sharp decline in occupancy. However, Regional France withstood better, recording encouraging increases in RevPAR (+4% to +9%, depending on the category), boosted by growth in average rates.

nces communicated by our partner, STR, signalled some hope for July. Paris and the Côte d’Azur finished July on a very negative note, with RevPAR significantly dropping in all categories, given the sharp decline in occupancy. However, Regional France withstood better, recording encouraging increases in RevPAR (+4% to +9%, depending on the category), boosted by growth in average rates.

nces communicated by our partner, STR, signalled some hope for July. Paris and the Côte d’Azur finished July on a very negative note, with RevPAR significantly dropping in all categories, given the sharp decline in occupancy. However, Regional France withstood better, recording encouraging increases in RevPAR (+4% to +9%, depending on the category), boosted by growth in average rates.Euro 2016 boosts revenues…in regional France

HOTEL INDUSTRY PERFORMANCES – JUNE 2016

Regional France was able to capitalise on the Euro 2016 championship to build on the encouraging results posted at the start of the year, with all categories recording higher  RevPAR at the end of the first semester. Conversely, and for too long now, there was yet more bad news for Paris in June, with hotels finishing the month and the first semester in the red – fairly significantly so, and a definite cause for concern!

RevPAR at the end of the first semester. Conversely, and for too long now, there was yet more bad news for Paris in June, with hotels finishing the month and the first semester in the red – fairly significantly so, and a definite cause for concern!

RevPAR at the end of the first semester. Conversely, and for too long now, there was yet more bad news for Paris in June, with hotels finishing the month and the first semester in the red – fairly significantly so, and a definite cause for concern!

RevPAR at the end of the first semester. Conversely, and for too long now, there was yet more bad news for Paris in June, with hotels finishing the month and the first semester in the red – fairly significantly so, and a definite cause for concern!A sunny month of May for regional France

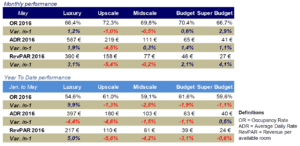

HOTEL INDUSTRY PERFORMANCES – May 2016

Following a month of April when all regions recorded losses, the contrast in May’s performance from one zone to the next was striking. Unfortunately, Ile-de-France  continued to pay the heavy price of the terrorist attacks of early 2015 and in Brussels. All client segments were affected and while recovery should be on the cards, it has yet to make itself known. The situation was noticeably different in regional France:

continued to pay the heavy price of the terrorist attacks of early 2015 and in Brussels. All client segments were affected and while recovery should be on the cards, it has yet to make itself known. The situation was noticeably different in regional France:

somewhat mixed on the Côte d’Azur, but very encouraging in regional France.

continued to pay the heavy price of the terrorist attacks of early 2015 and in Brussels. All client segments were affected and while recovery should be on the cards, it has yet to make itself known. The situation was noticeably different in regional France:

continued to pay the heavy price of the terrorist attacks of early 2015 and in Brussels. All client segments were affected and while recovery should be on the cards, it has yet to make itself known. The situation was noticeably different in regional France:somewhat mixed on the Côte d’Azur, but very encouraging in regional France.