Archives

L’hôtellerie française démarre bien l’année

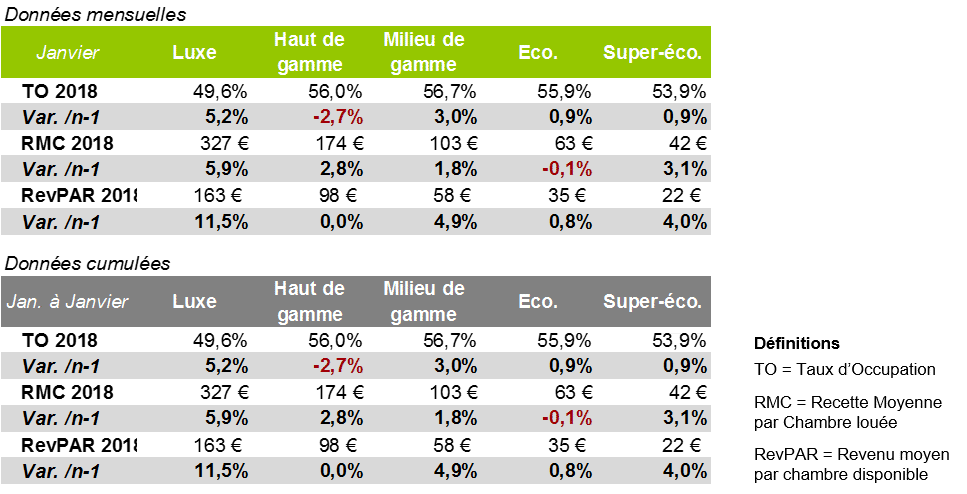

PERFORMANCES HÔTELIÈRES – JANVIER 2018

Au sein de l’industrie hôtelière française, les chiffre d’affaires hébergement (RevPAR) sont en croissance sur l’ensemble des catégories en ce tout début d’année 2018. Les taux d’occupation et prix moyens sont en progression sur la plupart des catégories. Seule, l’hôtellerie Haut de gamme affiche un repli d’occupation d’environ 3% et l’Economique une légère baisse du prix moyen. Dans ce panorama national, les progressions de RevPAR ont été principalement soutenues par la région Île-de-France et la Côte d’Azur. L’hôtellerie Milieu de gamme et de Luxe se démarquent en janvier. Le segment Milieu de gamme enregistre une progression de RevPAR sur l’ensemble de l’hexagone. L’hôtellerie de Luxe, quant à elle, affiche la plus forte croissance de RevPAR, portée par le marché parisien et Azuréen.

lire l’article complet Communiqué_Janvier_2018

2017 : Reprise pour l’hôtellerie française !

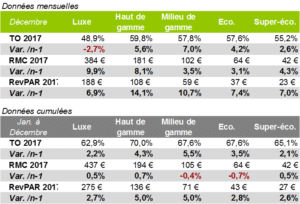

PERFORMANCES HÔTELIÈRES – DECemBRE 2017

Le marché hôtelier français enregistre de bons résultats au mois de décembre 2017 et termine très bien l’année. La France devrait conserver cette année encore sa place de première destination touristique internationale avec 89 millions de touristes (+6% par rapport à 2016). Les taux d’occupation et les prix moyens par chambre louée progressent sur l’ensemble des catégories ce mois-ci. Seule, l’hôtellerie de Luxe, affiche une baisse d’occupation. Les chiffres d’affaires hébergement (RevPAR) sont en croissance en décembre sur toutes les catégories. En cumul à fin décembre 2017, les RevPAR sont en progression sur toutes les zones géographiques et sur l’ensemble des catégories, excepté l’hôtellerie Super-économique azuréenne, dont le net retrait s’élève à presque 5% par rapport à 2016 et de 13% depuis 2013. Enfin, et malgré leurs progressions, les niveaux de chiffre d’affaires hébergement sur la capitale restent inférieurs à ceux enregistrés entre 2013 et 2015.

lire l’article complet Communiqué_Décembre_2017

2017 s’achève sur une bonne tendance

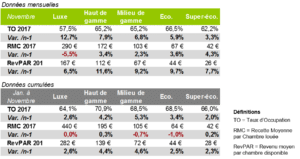

PERFORMANCES HÔTELIÈRES – NovemBRE 2017

Au mois de novembre 2017, la fréquentation est en croissance sur l’ensemble des catégories au sein de l’hôtellerie française, allant de 3% sur l’hôtellerie Super-économique à 13% sur le Luxe. Quant au prix moyen, seul le segment Luxe affiche un repli de près de 6% et cela suite à un recul de celui-ci en Régions et sur la Côte d’Azur. Sur les autres gammes, le revenu par chambre louée progresse, de 2% sur l’hôtellerie Milieu de gamme jusqu’à 4% sur le Super-économique. Les RevPAR sont en progression sur toutes les catégories dont sur le segment Luxe. En cumul sur 11 mois, les RevPAR progressent de l’ordre de 2% à 5% grâce au soutien de la fréquentation sur l’ensemble des territoires.

lire l’article complet Communiqué_Novembre_2017

Une année qui devrait bien se terminer !

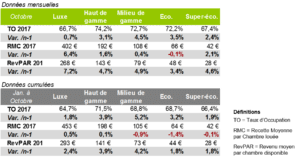

PERFORMANCES HÔTELIÈRES – OCTOBRE 2017

Les résultats du mois d’octobre sont dans l’ensemble positifs. D’une part, les taux d’occupation au sein de l’hôtellerie française sont en progression sur l’ensemble des catégories, allant de 1% sur la catégorie Luxe à 5% sur l’hôtellerie Milieu de gamme. D’autre part, les prix moyens sont en hausse sur tous les segments, hormis une légère baisse sur le marché Economique. En lien avec la hausse des taux d’occupation et l’augmentation des prix moyens, les RevPAR dans l’hôtellerie française sont en croissance de 3% sur la catégorie Economique, à 7% sur le Luxe. En cumul à fin octobre 2017, on

observe un recul du prix moyen au sein de l’hôtellerie d’entrée de gamme (Super-économique et Economique) et milieu de gamme. Toutefois, sur ces 10 premiers mois, les RevPAR affichent une progression sur l’ensemble des catégories, de 2% à 4%.

lire l’article complet Communiqué_Octobre_2017

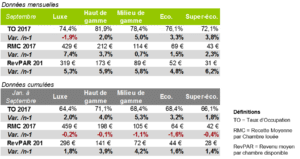

Des performances positives en septembre

PERFORMANCES HÔTELIÈRES – Septembre 2017

L’activité touristique au troisième trimestre 2017 est soutenue sur la plupart du territoire français. En données cumulées sur ces trois mois, la fréquentation aérienne sur le territoire national a progressé de l’ordre de 6% et atteint pour la première fois le cap des 120 millions de voyageurs à ce stade de l’année.

Après avoir signé une belle saison estivale, l’hôtellerie française enregistre de très bons résultats au mois de septembre, avec des progressions sensibles à la fois de la fréquentation et des prix moyens.

Grâce à cette augmentation, les RevPAR sont en hausse sur l’ensemble des catégories au mois de septembre, que ce soit en région parisienne, en Province ou sur la Côte d’Azur. A fin septembre 2017, l’hôtellerie française enregistre une augmentation d’environ 3% de RevPAR, portée par une nette progression de la fréquentation de presque 4%.

lire l’article complet Communiqué_Sept_2017

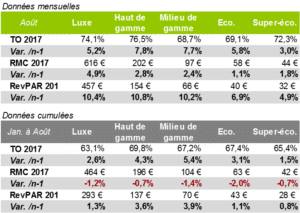

Une saison estivale confirmant la reprise

Cet été, la reprise de la clientèle étrangère se confirme en France. La clientèle “long-courrier” a spécifiquement plébiscité le territoire français. Après un mois de juillet avec des taux d’occupation en progression et des prix moyens en repli, tous les indicateurs sont dans le vert au mois d’août au sein de l’hôtellerie française, avec des RevPAR en progression de 5% sur le marché Super-économique à 11% sur l’hôtellerie Haut de gamme. Ce mois-ci, la Province et la Côte d’Azur inscrivent de meilleurs résultats qu’au mois de juillet. Sur les huit premiers mois de l’année, la fréquentation est en hausse contre des recettes moyennes par chambre louée en retrait. Grâce à la fréquentation soutenue sur l’hexagone, les RevPAR restent en progression à fin août 2017.

lire l’article complet Communiqué_Août_2017

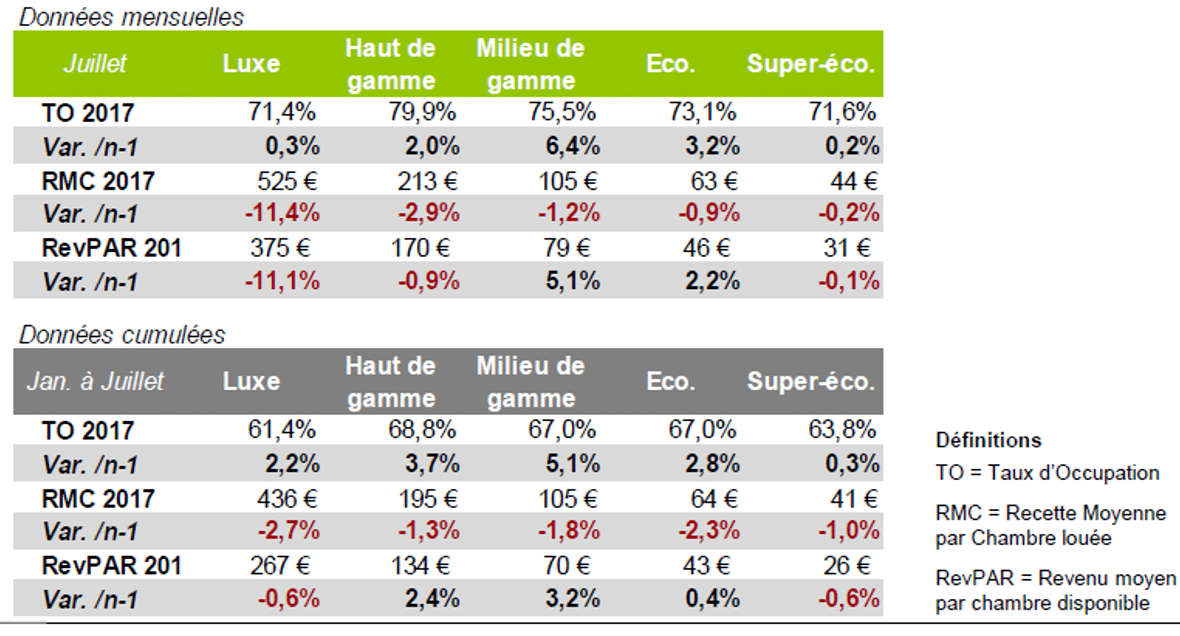

Prémices du retour des clientèles internationales

conséquence, les RevPAR progressent sur les marchés Economique et Milieu de gamme uniquement, respectivement +2% et +5% au mois de juillet 2017. Disparus des radars suite à la réticence des agences de voyages après les attentats en Europe, les touristes étrangers font leur grand retour sur certaines destinations en France cet été. Certains établissements hôteliers et professionnels du tourisme ont pu constater un retour de ces clientèles, notamment sur les segments individuels. Malgré tout, l’effet Brexit se fait ressentir. La clientèle britannique, habituellement nombreuse, s’est faite plus discrète, comme par exemple en Normandie et en région Provence-Alpes-Côte d’Azur.

conséquence, les RevPAR progressent sur les marchés Economique et Milieu de gamme uniquement, respectivement +2% et +5% au mois de juillet 2017. Disparus des radars suite à la réticence des agences de voyages après les attentats en Europe, les touristes étrangers font leur grand retour sur certaines destinations en France cet été. Certains établissements hôteliers et professionnels du tourisme ont pu constater un retour de ces clientèles, notamment sur les segments individuels. Malgré tout, l’effet Brexit se fait ressentir. La clientèle britannique, habituellement nombreuse, s’est faite plus discrète, comme par exemple en Normandie et en région Provence-Alpes-Côte d’Azur.lire l’article complet Communiqué_Juillet_2017

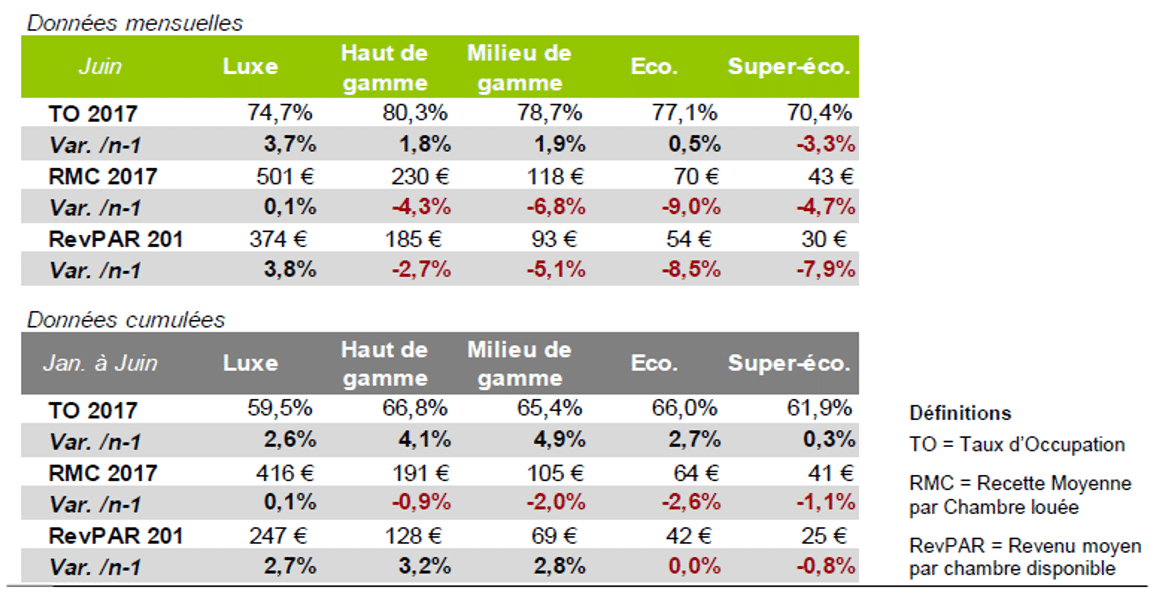

Bilan du premier semestre 2017

étrangers à Paris. Tout de même, le secteur est marqué ce mois-ci par des différences selon les territoires. Globalement, à l’échelle nationale, les RevPAR régressent sur l’hôtellerie d’entrée de gamme et progressent sur les catégories supérieures au premier semestre 2017.

étrangers à Paris. Tout de même, le secteur est marqué ce mois-ci par des différences selon les territoires. Globalement, à l’échelle nationale, les RevPAR régressent sur l’hôtellerie d’entrée de gamme et progressent sur les catégories supérieures au premier semestre 2017.lire l’article complet Communiqué_Juin_2017

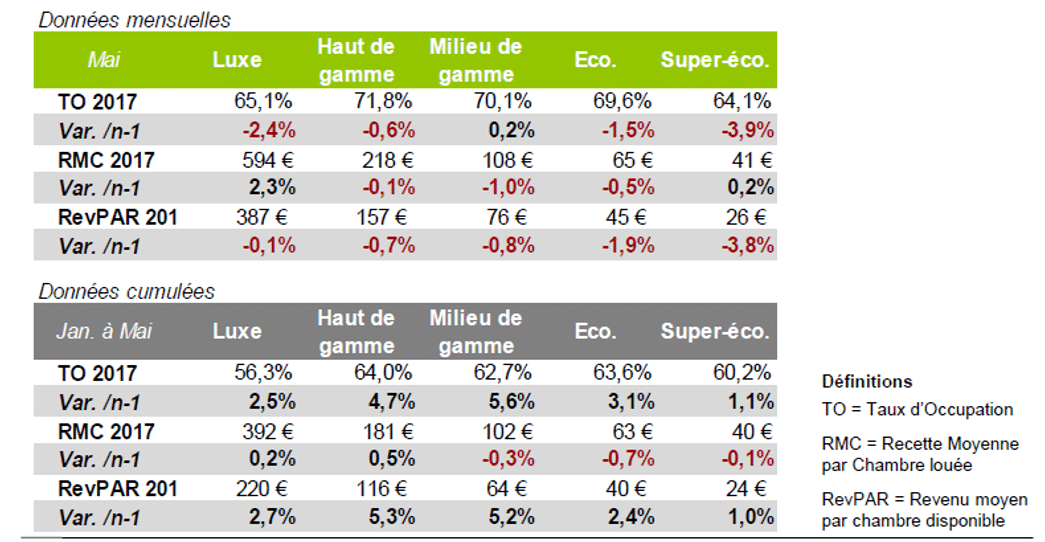

Un mois de mai en demi-teinte

Le calendrier, plus généreux en jours fériés ouvrés, a limité les déplacements affaires et la clientèle d’agrément n’a pas suffisamment pris le relais. La Côte d’Azur est la zone la plus en retrait ce mois-ci, voire en cumul depuis le début de l’année, tandis que l’Ile de France confirme dans l’ensemble une tendance haussière. Malgré tout, sur l’ensemble du territoire, et en cumul depuis le début de l’exercice, les résultats restent en progression sur l’ensemble des catégories.

Le calendrier, plus généreux en jours fériés ouvrés, a limité les déplacements affaires et la clientèle d’agrément n’a pas suffisamment pris le relais. La Côte d’Azur est la zone la plus en retrait ce mois-ci, voire en cumul depuis le début de l’année, tandis que l’Ile de France confirme dans l’ensemble une tendance haussière. Malgré tout, sur l’ensemble du territoire, et en cumul depuis le début de l’exercice, les résultats restent en progression sur l’ensemble des catégories.lire l’article complet Communiqué_Mai_2017

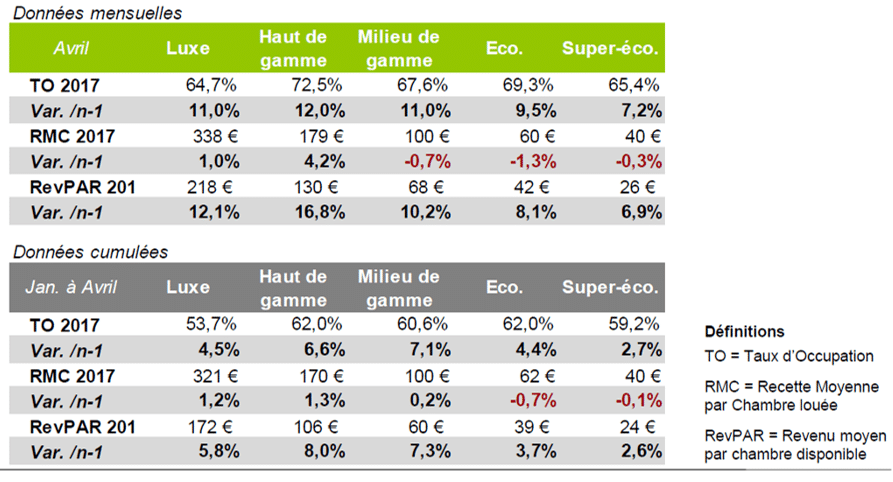

La clientèle internationale est de retour

scolaires de Pâques pour toutes les zones. C’est donc bien le segment loisirs qui soutient l’activité avec notamment le retour des clientèles internationales. Si les prix moyens sont dans l’ensemble stables, la fréquentation est en progression très sensible et tire le chiffre d’affaires vers le haut. A fin avril, les RevPAR sont en progression pour l’ensemble des catégories (de +2,6 à +8%). Notons les très belles performances des littoraux français qui auront su capitaliser sur cette dynamique et une météo plutôt favorable.

scolaires de Pâques pour toutes les zones. C’est donc bien le segment loisirs qui soutient l’activité avec notamment le retour des clientèles internationales. Si les prix moyens sont dans l’ensemble stables, la fréquentation est en progression très sensible et tire le chiffre d’affaires vers le haut. A fin avril, les RevPAR sont en progression pour l’ensemble des catégories (de +2,6 à +8%). Notons les très belles performances des littoraux français qui auront su capitaliser sur cette dynamique et une météo plutôt favorable.lire l’article complet Communiqué_Avril_2017